We recently filed a request with LA county to investigate the fraudulent documents in the L A County Record system. These banks DID NOT clean these docs – and they are actually using these docs to evict homeowners – and purchase homes at lower prices to gentrify our community.

Los Angeles County Department of Consumer and Business Affairs Real Estate Fraud Hotline at (800) 973-3370. Report anyone whom you suspect. They are VERY responsive to consumers. (More than CA Attorney General who told us to “go get a lawyer” – basically, “I don’t care about Homeowner Bill of Rights”)

In 2012, CBS 60 minutes covered the story of ROBO-SIGNING

Facing foreclosure, Lynn Szymoniak decided to fight back against her bank on charges of fraudulent paperwork. Scott Pelley reports Szymoniak will be paid $18 million for uncovering the massive foreclosure fraud that was used on thousands of homeowners. LINK

Many homeowners forget to examine their county records because we are often overwhelmed. But it is simple enough to do. Check this list

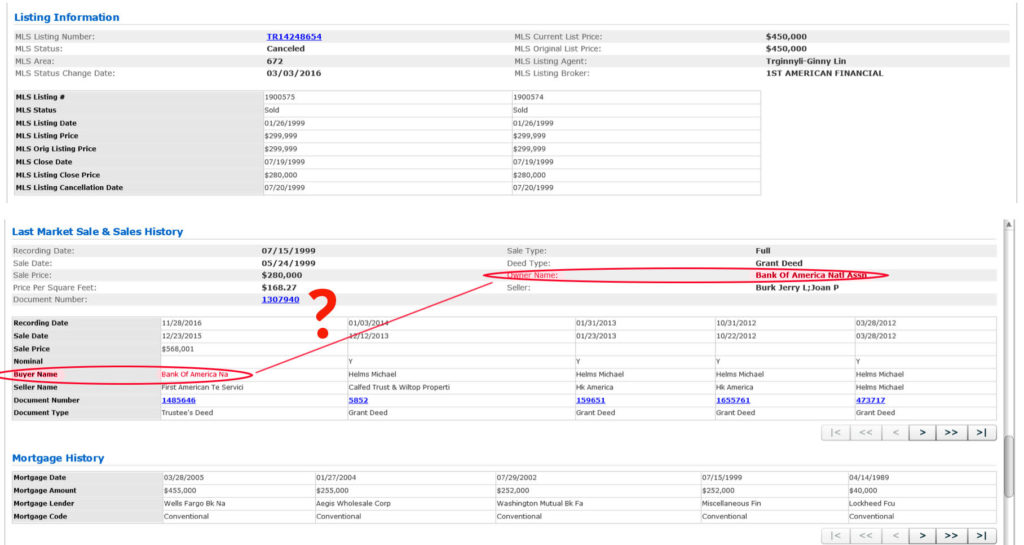

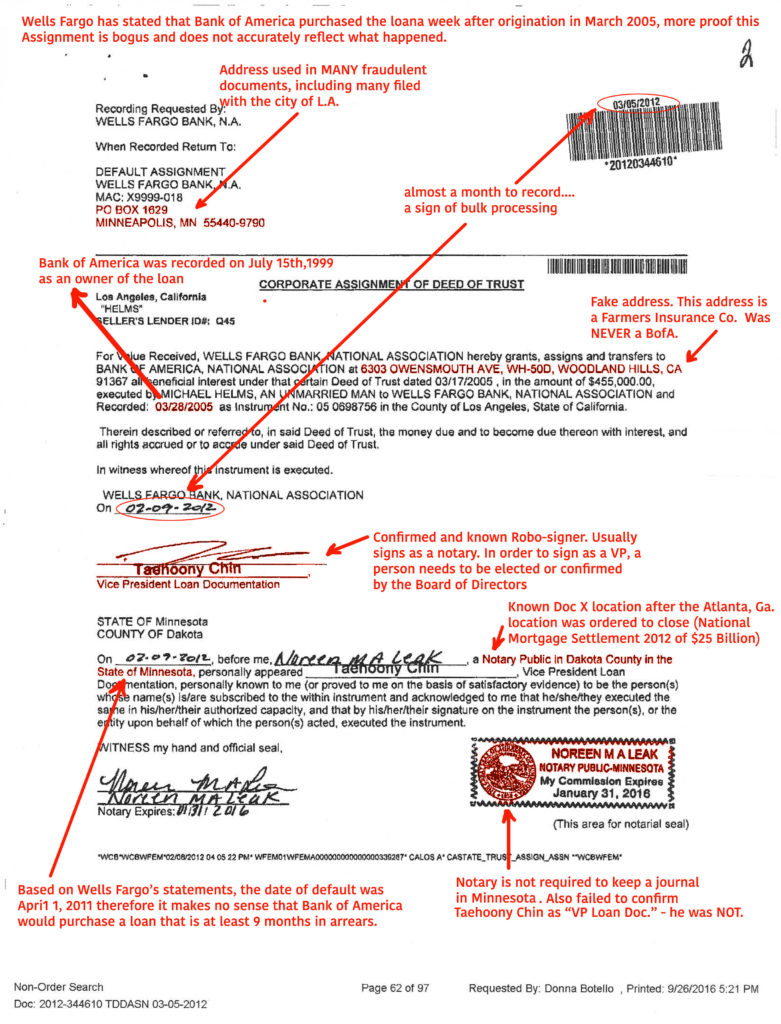

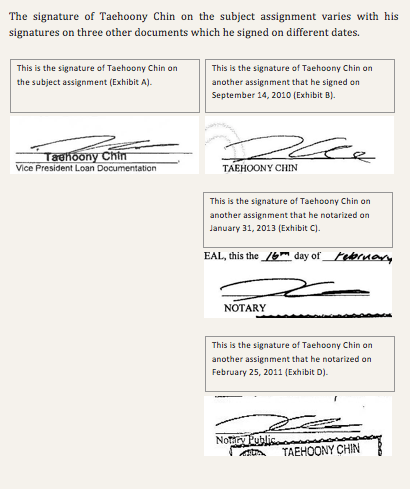

Here’s one of many fraudulent docs that Wells Fargo filed. This is CORPORATE ASSIGNMENT OF DEED OF TRUST. It is signed by Taehonny Chin, Vice President Loan Documentation on 2/9/12 However, when I hired an investigator, he found several signatures done by Taehoony Chin. Reminder: This is all public information. The rank of a vice-president is a senior executive position that requires the appointment or confirmation by the board of directors.

Why Wells Fargo has an “office” in Minnesota? Because the State of Minnesota does not require its notaries to keep journals. ” While Minnesota law does not require a journal, it is prudent of a notary public to keep one.” It’s not possible to get a copy of the notary journal in order to verify the legitimacy of this doc.

This document consists of two pages and pertains to Taehoony Chin as a witness, on 5/6/2010 – for VP of Loan Documentation Michael Snively https://www.skagitcounty.net/AuditorRecording/Documents/RecordedDocuments/2010/09/23/201009230029.pdf

Taehoony, who was a Vice President of Loan Documentation on 2/9/12 was a Notary on Feb 16. 2011, just one year before he signed my doc. http://deeds.desotocountyms.gov/T/T03278-00356.pdf https://sussex.landrecordsonline.com/sussex/search.do?indexName=susseximages&lq=Instrument%3A20130328010076110.

Taehoony Chin also signed an Assignment of Mortgage for Mortgage Electronic Registrations Systems, Inc. (MERS) as Assistant Secretary on March 28, 2013. This appears to conflict his position as Vice-President for Wells Fargo Bank, NA. (If the link doesn’t work, please cut and paste this to your browser) https://sussex.landrecordsonline.com/sussex/search.do?indexName=susseximages&lq=Instrument%3A20130328010076110

Also, we discovered that the address of Bank of American (6303 Owensmouth Ave., WH-50D, Woodland Hills 91367) on this document, was not Bank of America office. It’s Farmers’ Insurance building and there never was a BofA office, according to the building records.

BASED ON THIS PIECE OF PAPER – THE HOUSE WAS “SOLD” (not really – just “transferred” because there is no $ transaction) – to Bank of America.

What is Robo-Signing?

In the mortgage industry, robo-signing is the practice of an employee signing thousands of documents and affidavits without verifying the information contained therein. Some reports have revealed that one bank official signed off on almost 10,000 documents in one month. The practice calls into question the validity of thousands of mortgage assignments and foreclosures across the country.

Banks have been under investigation since 2010 for their part in the robo-signing scandal which resulted in many homeowners losing their homes without merit. After the scandal came to light, the banks said they would no longer engage in this practice. However, as recently as July 2011, it was discovered that mortgage robo-signing was still being practiced.

When the practice recently came to light, four major banks, JP Morgan Chase, Ally Financial/GMAC, Bank of America, and Wells Fargo all called a halt to foreclosure actions in 23 states. In the days following their announcements, Bank of America ceased foreclosures in all 50 states. A coalition of 40 attorneys general plan on launching a probe into mortgage-servicing practices and may hold them accountable where there were violations of state foreclosure laws.

Robo-Signer

A robo-signer is a person in a legal document processing assembly line whose only task is to sign previously-prepared documents affecting title to real property in a robotic-like fashion without reading the documents or verifying the facts contained therein by reviewing primary source evidence. The robo-signer’s mission is to expedite the documents’ recordation in the public land records or in court proceedings. Additionally, robo signers regularly fail to establish or simply do not have the authority to execute these documents on behalf of the legal title holder or principal on whose behalf they purport to act.

Surrogate Signer

A surrogate signer is a person who signs a legal document on behalf of and in the name of another without reading it or understanding the document’s contents. Surrogate signers are not authorized to execute these documents on behalf of the legal title holder or principal on whose behalf they purport to act.

Robo-Signing is Forgery

Forgery is the creation of a false written document or alteration of a genuine one, with the intent to defraud. Forgery consists of filling in blanks on a document containing a genuine signature, or materially altering or erasing an existing instrument. An underlying intent to defraud, based on knowledge of the false nature of the instrument, must accompany the act. Hill, G. and Hill, K. Forgery, Retrieved August 25, 2014, from http://legal-dictionary.thefreedictionary.com/forgery

Forgery is a Felony

“This is the first time any grand jury in the country has indicted a corporation or a high-level executive at a corporation for ‘robo-signing,'” Missouri Attorney General Chris Koster told The Huffington Post. “The grand jury is alleging that the documents have false signatures on them, that the notarizations are fraudulent and that it was all done with intent to deceive. If that’s true, it makes the documents forgeries.” Levine, D.M., In DocX Case, Robo-Signing Forgery Charge Hits Top Executive, Retrieved August 25, 2014 from http://www.huffingtonpost.com/2012/02/07/robo-signing-docx-missouri_n_1261369.html

Perjury

A crime that occurs when an individual willfully makes a false statement during a judicial proceeding, after he or she has taken an oath to speak the truth.

The common-law crime of perjury is now governed by both state and federal laws. In addition, the Model Penal Code, which has been adopted in some form by many states and promulgated by the Commission on Uniform State Laws, also sets forth the following basic elements for the crime of perjury: (1) a false statement is made under oath or equivalent affirmation during a judicial proceeding; (2) the statement must be material or relevant to the proceeding; and (3) the witness must have the Specific Intent to deceive. Perjury; Legal Dictionary, Retrieved December 9, 2015.