– Please sign this Petition – Let the HELMS buy their house back! & Wells – STOP the fraud Change.org

Wells Fargo Killed my Husband … Almost

Our federal case has been open since April 2017. Currently in U.S. Court of Appeals, Ninth Circuit. – Case #18-56559. (plus LA county Real estate fraud unit has on-going investigation )

During our first hearing in July 2017, Judge Consuelo Marshall asked Wells Fargo attorney Andrew Minegar of Severson and Werson, if the title was perfected, and his answer was “Yes, your honor”

Instead of screaming “THAT’S A LIE!” ,in court, we have had to spend time and money to prove why his statement is a lie by providing evidence of frauds, even though sometimes the frauds were non-existence transactions, or records & notes, or, in our case trying to find the “investor.”

That lawyer was removed from the case shortly after. But his statement was recorded in the transcripts.

On Oct 18, 2017, two LA County sheriffs showed up on our door step in early morning, banging on the door to evict us. It was so loud it sounded like guns shots. My son screamed. When we looked out the door, the two sheriffs were standing there with their hands on their guns and demanding we open the door and get out!

A day before, my husband was told that he had to have open heart surgery because he was at extremely high risk of heart attack or stroke. He had a severe Mitral Valve Prolapse AND Atrial Fibrillation.

The morning the Sheriffs showed up at our door I had said to my husband, “Let’s keep fighting this thing but let’s take care of your health first.”

At that time, we had no idea how long his recovery would take, how much it was going to cost us, and how long it would be if/when he was able to go back to work. Now we have no idea where we would live, how our child would respond to being uprooted and where he would/could go to school, or what the future would hold for our home.

My husband made 3 trips taking whatever he could carry to the car but then the Sheriffs blocked the door to the house, stood in front of it with their hands on their guns, and would not let him back in the house even though my 5 year old little boy and I were still inside. Our little boy started crying and asking why they were making us leave. My husband came up with an idea and told him we were going to have some fun and camp out in our close friend’s back yard. Indeed, he did…my husband and our little boy spent the next two nights camping (read homeless) in a friend’s back yard.

So,“Bank of America” evicted us by abusing the State Court in Pasadena, while our federal case was/is in process. California is non judicial foreclosure state. Most foreclosures are currently processed NOT “due diligently”. As the name implies, a lender need not hold a court hearing in order to carry out the foreclosure process and Pasadena is notorious for being merciless in eviction cases.

But my focus was to keep my husband from getting any sicker and to avoid adding any stress that could lead to him having a heart attack. We had to wait until January for our insurance coverage to kick in, so we didn’t have the health, time, or funds to fight the eviction.

All horror stories you hear about Wells Fargo are true and 98% of the foreclosed people have no choice but to give up. We knew if we were to fight the eviction, we needed another $5000 or so, in addition to $17,500 we had spent on the Federal case already.

Cause of the heart issue: Wells Fargo. “Some studies suggest that stress and mental health issues may cause your atrial fibrillation symptoms to worsen. High levels of stress may also be linked to other health problems. Coping with your stress is important for your health”.

Even though we are extremely fortunate, we have had to move three times so far. The sense of instability is mind-numbing. The studio, which is attached to the house and where we made our living, was taken away. We are still able to work independently to pay the bills but for 7 years we have been fighting Wells Fargo over this fraud when all we ever wanted was a loan modification and to live in our home. Now all that is gone.

Since the eviction, for over a year, there was NO movement on the house because of the Federal litigation. The house was just sitting there empty and falling into disrepair. Three big beautiful shade trees died and were cut down. The front fence was devoured by termites, knocked down, and only partially repaired.

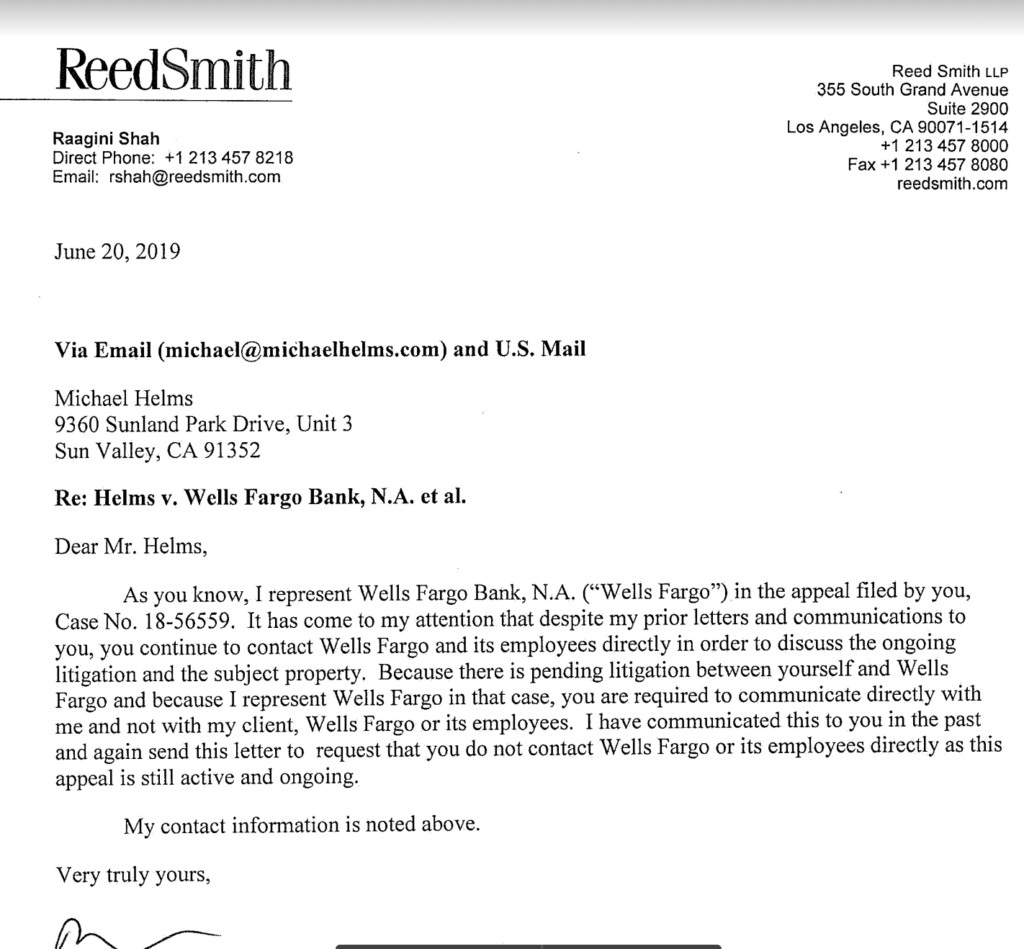

It was end of May 2019 when attorney Raagini Shah of Reed/Smith, representing Wells Fargo, said Wells Fargo was willing to sell the house for $620k at the lowest.

So we started to working on getting a home loan. It felt so bizarre to be attempting to buy back a house that was stolen from you.

On June 7th – Wells Fargo listed the house for sale for $575k. $45k lower than they offered it to us.

A week later after my initial contact with the listing agent Mike Anderson, a man called Hosep Stepanian called me back. He said the house was for sale for CASH only, No inspection, No Title insurance.

I called a highly respected mortgage broker Jason, a CalHFA rep who executes each mortgage with precision and very much “by the book”. He said “No title insurance – No loan.” I called a “hard cash guy” and he even said “No one would give you a loan without title insurance – unless you get some indemnity.”

I was devastated. The godfather of my son called Hosep, willing to lend us the cash to get the house for us.

Hosep told him the house was “already in escrow”.

That was fishy …who would say “no” to cash? Every real estate agent would at least take his info as back up.

About the same time, Raagini Shah of Reed/Smith, representing Wells Fargo, sent a letter saying,”DO NOT contact Wells Fargo or its agents”.

Things were getting weirder. We put up a banner to warn possible buyers: “Do not buy this house. It is involved in a Federal Law Suit”

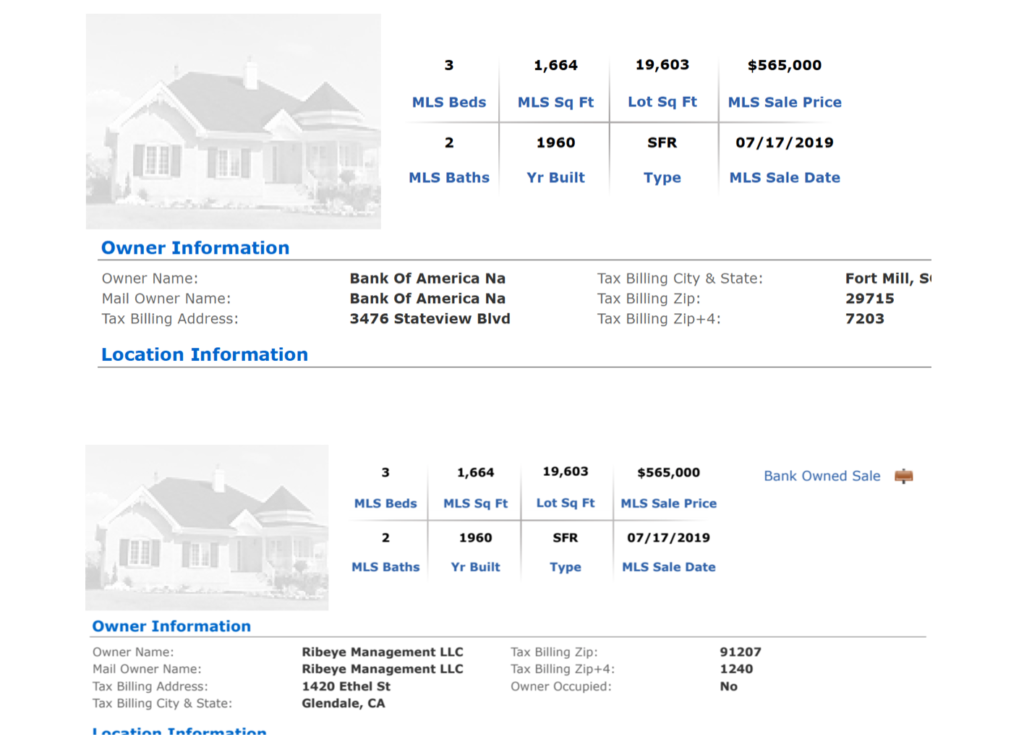

On Fri. July 12 – My neighbor called to say “Someone is in your house”. I rushed over there within 5 min – and met the guy who bought the house…with cash…and with title insurance, he claimed.

When I asked ” You know, we have an on-going litigation. How did you get title insurance with so many frauds on the title?” He said,”I guess we did all the work for you.” He agreed to give us an AS IS cash price.

That was the last time we saw or heard of him. He was probably smart enough to null/void the transaction with Wells on this fraudulent sale.

It was becoming pretty clear that there were some closed door dealings among the Wells Fargo lawyers / reps and investor/real estate agents involved and that they were blocking us from buying the house. I continued to check property records three times a day. That constitutes a conspiracy, which by the way, is a legal term. (https://definitions.uslegal.com/c/conspiracy)

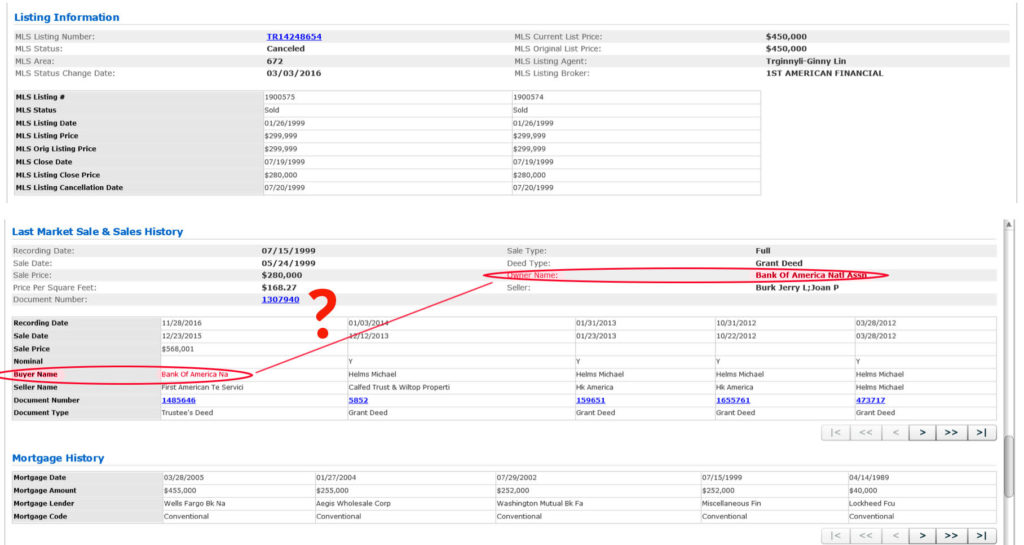

On July 17 – Bank of America sold the house to Bank of America again (yes – they sold it to themselves), – and a few days later, a transaction to Ribeye Management was recorded as on the same day, July 17.

I was able to find who “Ribeye” was and emailed his Dilbeck address. I had a nice conversation when I talked to him the following Monday, until he sent me a threatening text message.

(Insert “threatening to sue” text message here)

If he is willing to sell the house to us, why was he bothered by the banner we put up?

We wonder if he read about our struggle? We wonder if he has any intention informing any potential buyer about the pending Federal litigation? Is it ethical for a real estate agent/investor to not disclose it?

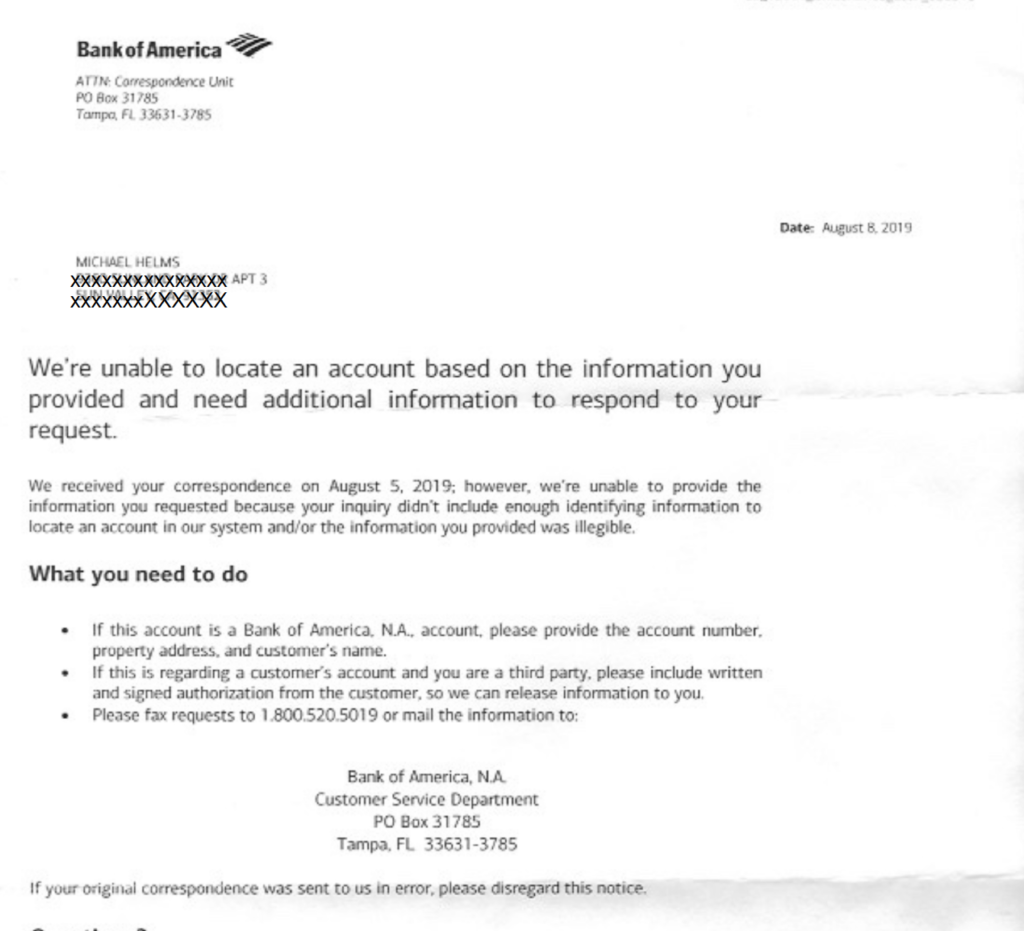

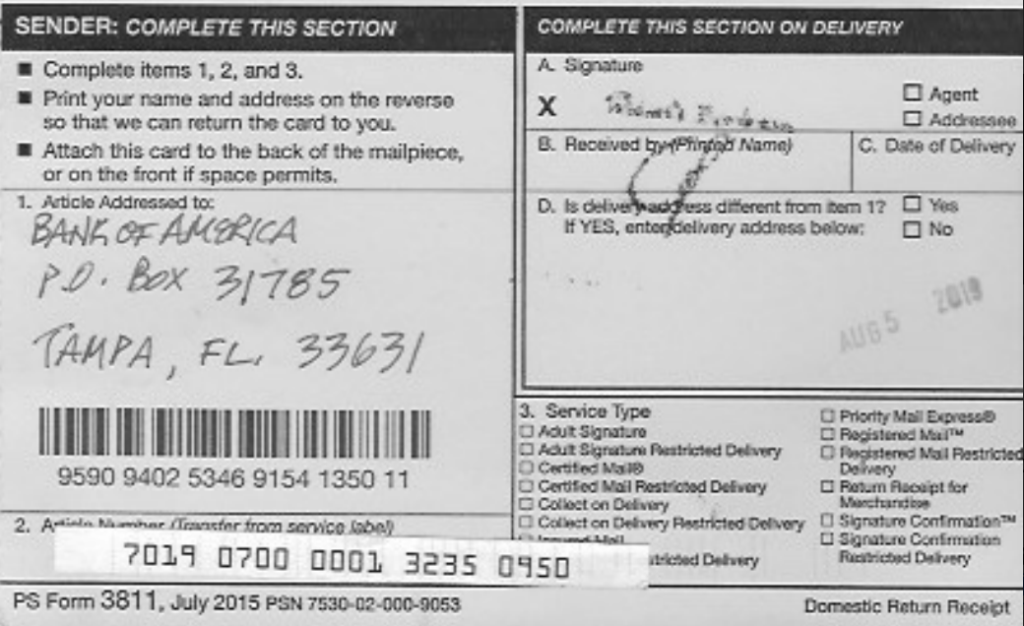

I sent yet another Qualified Written Request when I saw the new transaction, thinking since “Bank of America” is again showing on the record, they may have updated the transaction on their records. Last week, Bank of America sent us TWO letters – each letter requesting we send a letter to the address of the other letter.

So how does an investor, who does not know us, evict us? How do they not know the house they own was sold?

This is Wells Fargo’s fraudclosure pattern. Bifurcation and they make up documents to push through the foreclosure and eviction. That was why the big 5 banks were fined $25 Billion in 2012. But they continue to commit the same types of frauds because they make more money doing things illegally (and paying fines IF/WHEN they get caught) than to do things legally.

In California – the wave of buying foreclosures with made up ownerships and fake paperwork is finally coming to the attention of our legislators as a significant contributor to homelessness. And “flippers” or “gentrifiers” are being considered a part of the problem due to the non judicial foreclosure process and homelessness issues.

https://livinglies.me/wp-content/uploads/2019/07/2019.07.15-Minute-order-for-MSJ-1.pdf & https://www.sacbee.com/news/politics-government/capitol-alert/article233626287.html

SO here we are, 2 years later and still not back in our home … all because a Wells Fargo loan officer LIED to my husband about how to get a loan modification. This is Wells Fargo’s pattern and they continue to do this to MILLIONS of home owners every year.

Homeowners, please do not give up and be silenced. Another wave of foreclosure may be coming and we must speak against the fraud.

Fight continues.

Thank you for your support,

Kaz