WHO OWNES THE NOTE? NO ONE!

Property address: 10349 Siesta Dr., Shadow Hills CA 91040

March 17, 2005 – DoT Lender – Wells Fargo Bank, N.A. $455,000.00. 24. Substitute Trustee. Lender, as an option, may from time to time appoint a successor trustee to any Trustee appointed hereunder by an instrument executed and acknowledged by Lender, and recorded in the office of the Recorder of the county in which the Property is located. The instrument shall contain the name of the original Lender, Trustee and Borrower, the book and page where this Security Instrument is recorded and the name and address of the successor trustee.

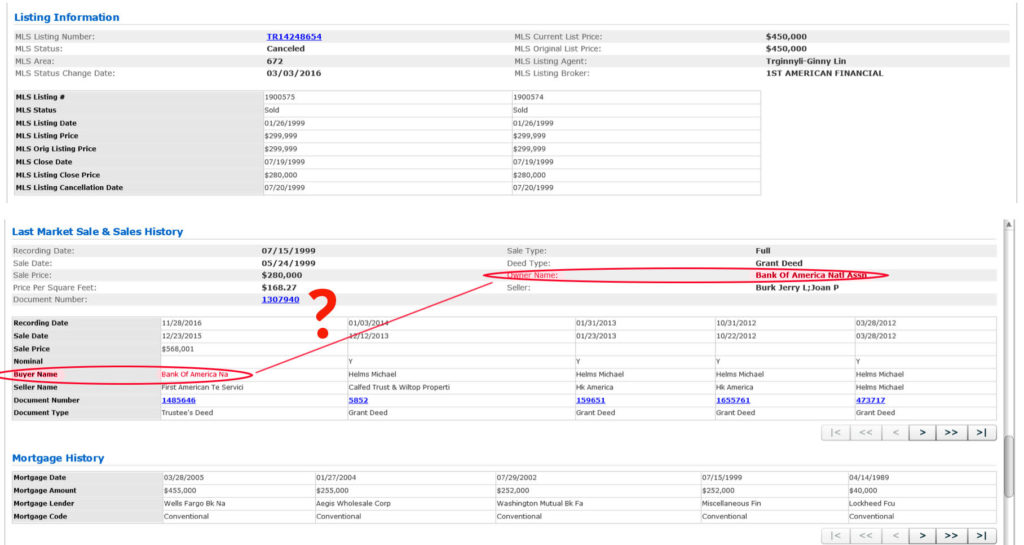

March 29, 2005. Owner/Assignee Bank of America, N.A. Loan acquired 3/29/2005. (x1)

April 1, 2011 – Date of Default

July 12, 2011 – Note and Deed of Trust – Foreclosure

Nov 14, 2011 – Appointment of Successor Trustee. Wells Fargo Bank, N.A. is the beneficiary and claimed present holder or the authorized agent of the holder of the Note. By Robert Bourne, Certifying Officer, Wells Fargo Bank, by First American Trustee Servicing Solutions, LLC, as its Attorney in Fact.

The appointment of Successor Trustee is signed by First American Trustee Servicing Solutions, LLC as Attorney in Fact, the “attorney in fact” or POA must be provided to prove that First American did in fact have authority as WF’s attorney in fact.

Also the DoT states that only the Lender has the authority to appoint a successor trustee. This is a contract signed by the borrower and the terms can not be altered or changed without the permission of the borrower. Based on this the contract, the DoT, only Wells Fargo itself has the authority to appoint a successor trustee.

Wells Fargo’s documents state that Bank of America purchased the loan in March, 2005, then it would be only Bank of America that would have the authority to appoint a successor trustee.

December 05, 2011 Notice of Trustee’s Sale.

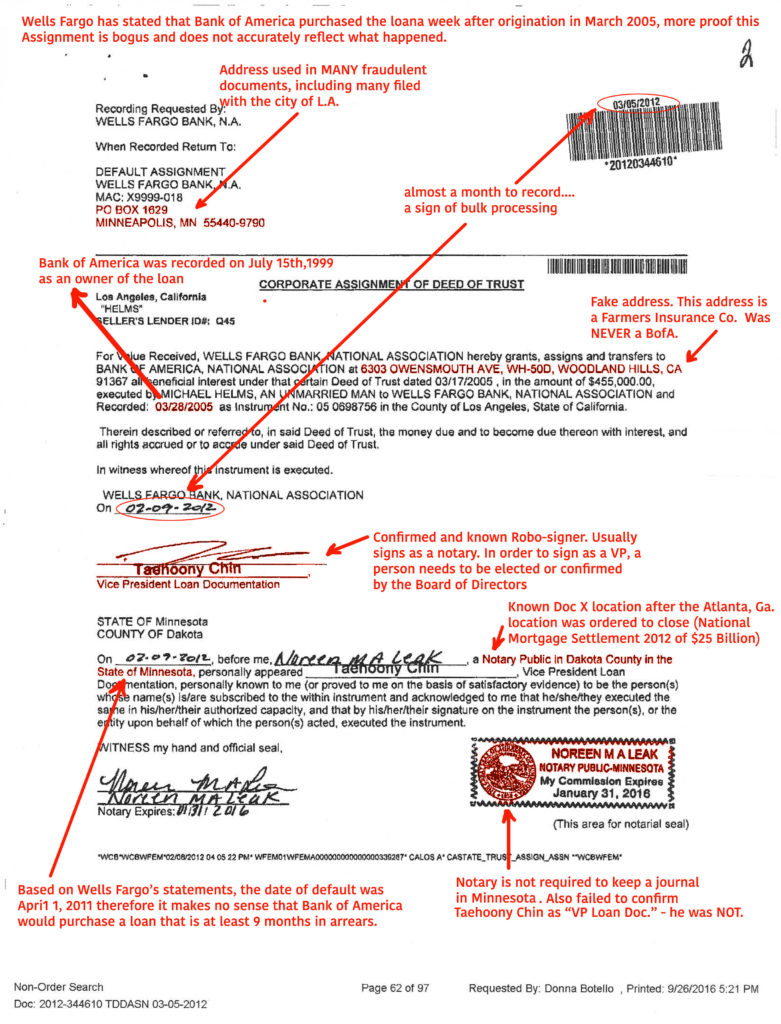

February 09, 2012. Corporate Assignment of Deed of Trust. Wells Fargo Bank, N.A. assigns/transfers to Bank of America, N.A. (6303 Owensmouth Ave., WH-50D, Woodland Hills, CA 91367. (check Robo-Sign) (x2)

The Assignment is fraudulent. Based on Wells Fargo’s statements, the date of default was Apri1 1, 2011 therefore it makes no sense that Bank of America would purchase a loan that is at least 9 months in arrears.

Additionally, Wells Fargo has stated that Bank of America purchased the loan a week after origination in March 2005, more proof this Assignment is bogus and does not accurately reflect what happened.

SO… Wells Fargo sold the investor Bof A’s house to BofA

March 13, 2013 Notice of Trustees’ Sale for April 9, 2013.

April 26, 2013 Notice of Trustee’s sale for May 21, 2013

September 4, 2013 – Notice of Trustee sale for Sept 30, 2013

September 5, 2014 – Notice of Trustee sale for Sept 30, 2014

September 4, 2015 – Notice of Trustee sale for October 6, 2015.

Dec 01, 2015 – Notice of Trustee sale for Dec 23, 2015

December 23, 2015 – Helms files Chapter 13

Feb 2016-Sept 2016 – Negotiating a loan mod from Allegations of dual tracking.

Sept 27, 2016, Issued notice of rescission.

Oct 13, 2016 WF letter – included Note Assignments, Loan Info Report. Owner/Assignee Bank of America, N.A. Loan acquired 3/29/2005. Loan originated 3/17/2005. Loan amount $155,000.00. Unpaid first principal bal. $414,936.60. July 12, 2012, initiated foreclosure action, payment due for April 1, 2011. Property sold at foreclosure sale on December 23, 2015. (x3)

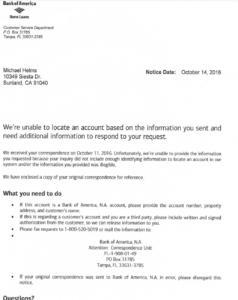

October 14, 2016 BofA letter. “We’re unable to locate an account based on the info you sent and need add’l info to respond to your request.”

November 10, 2016 BofA letter. Bank of America is the investor of the loan.

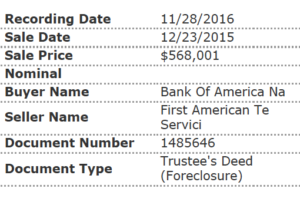

Nov 22, 2016 Trustees Deed Upon Sale – unpaid debt and amount pd by Grantee $568,001.31. Deed of Trust conveyed to Bank of America, N.A.

Oct. 18, 2017 – Bank of America initiates Eviction -without NOTE. Only Agencies of Wells Fargo showed up. Requested the investigation on “Bank of America / Wells Fargo” partnership of Michael Zeff, esq – An Encino eviction attorney. I just requested to the bar to see how we can really tell if Zeff was hired by BofA, not Wells Fargo.

We didn’t do “occupy” as we planned because Michael’s scheduled open heart surgery was just a month away.