We, along with many housing right groups, must push for the #cleantitleact.

Can a Wells Fargo Fraud happen … to anyone?

Step 1) Wells sends you a letter – encourage you to loan modify

Step 2) You apply – They deny. Their excuses are a) you are missing paperwork b) you don’t make enough, c) you make too much, d) you are a self-employed. e) “Not at this time.”

Step 3) Desparate, you go to a branch and their loan officer tells you – stop paying, otherwise, you are NOT a distressed homeowner.

Step 4) You follow his advice.

Step 5) At 3 month sharp – you get Notice of Default – and foreclosure hell begins.

Remember – You didn’t do anything wrong.

My Court History – Mortgage Fraud Explained.

———-

Not me, I thought. I would never fall for a Ponzi scheme, a pyramid business, or some other type of fraud. I am investigative, I read each contract, and I try to anticipate what could go wrong.

I read my loan mod papers that Wells Fargo presented in 2005 when I had to buy my ex out of our house. I double checked, then I triple checked with the Wells Fargo real estate agent who compiled the paperwork to confirm it was NOT a new sale but a refi, to make sure that I wouldn’t be subject to an increase in taxes.

He assured me there would be no problem and that it would NOT be recorded as a new sale. He lied. He made it as a new sale, and I was stuck having to pay extra taxes on my home.

(Strangely, when I checked the property tax records, the 2005 “sale” does not show up. What is that all about? )

So, I should have been extra cautious when a Wells Fargo Home Loan specialist told me to “stop making mortgage payments to be qualified for an affordable rate under the HAMP Program.”

From the Spring of 2009, I kept applying for loan modifications to lower my rate. The Fed gave money to Wells Fargo to stop the foreclosure crisis and there were several “save your home” programs I was clearly eligible for. I was paying 5.75% ($3150 a month) for a house that was worth less than my mortgage principle so I thought if I could lower the monthly payment to less than $2300 a month, I could survive the recession.

Think about this number for just a minute then think about all of the “problems” with Wells Fargo that are showing up in the news. Then think about all of the Americans who have lost their homes while NOT ONE of the Wells Fargo executives who caused this financial crisis were jailed for their purposeful decision to foreclose and take people’s homes.

I kept applying for loan mods – and Wells Fargo kept denying my applications, because I “made too much”, or “made too little”, or because I was “self employed”. The fact I had the house for 15 years, never missed a payment, had savings enough to cover two years of mortgage, equity in the house, and perfect credit, made no difference to Wells Fargo.

So, when the Wells Fargo loan specialist said to me “Who do you think Wells Fargo is going to help? The people who continue to pay the mortgage or the people who can no longer afford to pay?”

It made sense but it was a frightening proposition and counter to every fiber of my being but I, unfortunately, listened to the counsel of the Wells Fargo loan officer.

So in April 2011, I didn’t send my payment to Wells Fargo.

They called me – and I sent them another loan modification application.

In July 2011, 3 months after I stopped payment, Wells Fargo sent me a notice of default.

At first I felt conned, but then a banker at Citibank,where I had my business account, said “Don’t worry, they will work with you”.

They didn’t. Wells Fargo refused to work with me, and kept sending me “cash for Keys” and “short sale” notices.

When I hired Adelina Kazaryants, in December 2011, an attorney at Simon Resnik in Sherman Oaks – She looked at my bank account, cash flow, and application, and asked, “Why weren’t you approved?”

That was my question! I had a good credit, some savings, and a solid business in spite of the recession.

She told me that she could get me a 2% fixed rate (which was available at that time).

4 weeks later, Wells Fargo told her that “Investor, at this time, decided not to make this loan. However, we can put him in the Trial Payment Plan.” After doing some research, I didn’t take the offer, because there was a lot of “fine print” items that looked very much like a scam to me. Turns out I was right.

TPP was yet another Wells Fargo scam that was later settled in a Class Action lawsuit. Many homeowners lost their houses as a result. (Insert the PDF files here). CORVELLO VS WELLS FARGO

One out of every 248 households in the United States received a foreclosure notice in September 2012, according to RealtyTrac.

My attorney was not willing to fight, so I sought another one through referrals.

The next attorney also turned out to be a scam artist (Shauna Giliberti – Union Allie)

Then yet another lawyer who did the math and applied for the “make your home affordable” program told me – “Don’t worry about it. Wells Fargo cannot sell your house because they don’t own the house – and even THEY don’t know who owns the house. Look at the county records!”

That’s when yet another red flag went up.

This attorney suggested I look up all the LA County Records on my house and get certified copies of everything.

I was surprised to find Notices of default, and Deeds of Trust were full of robo signed documents.

Basically, the chain of title was utterly broken, due to Wells Fargo and other banks, foreclosure processes and practices.

Truth: The Home Affordable Mortgage Program (HAMP) is not a guaranteed loan modification; it’s free, if your lender is participating; and, if you agree to a HAMP loan modification, you become worse off than a renter. The truth is, loan modification is not available because the Banks DO NOT own your Note. The Note was sold to a Trust, whose investors often won’t agree to a loan modification. Link

Here’s Wells Fargo’s Foreclosure Manual, the blue print of fraud. The manual, reviewed by The Washington Post, outlines steps for obtaining the missing document after the bank has initiated foreclosure proceedings. It also lays out what lawyers must do in the event of a lost affidavit or if there is no documentation showing the history of who owned the loan, paperwork the bank should already have.

Wells Fargo had no incentive to lower my mortgage in spite of the fact the government provided money for them to do so. They simply make more money from acquiring assets (foreclosing on properties) than they do on providing loan modification services to homeowners. Wells Fargo is in business to make money, so their business model is to acquire assets and that translates into a foreclosure mill.

Back then, I believed there was a way to get loan modification – since this was right after National Mortgage Settlement, and Wells Fargo was one of 5 bankers to sign it.

This bipartisan settlement has provided over $50 billion in:

- Relief to distressed borrowers in the states; and

- Direct payments to signing states and the federal government.

It’s the largest consumer financial protection settlement in US history.

The agreement settled state and federal investigations finding that the country’s five largest mortgage servicers routinely signed foreclosure related documents outside the presence of a notary public and without really knowing whether the facts they contained were correct. Both of these practices violate the law.

One thing I didn’t know until I got involved in the foreclosure process, is how many phone calls, emails (how do they find my email?), and postcards, I would get saying, “WE CAN HELP!”

One law firm claimed they could extend the sale of our house while we negotiated a deal with Wells Fargo. They attached a bankrupted company, as a co-owner, of our house – so Wells Fargo could not sell it. It sounded shady but at the time I was grasping at straws in order to not lose my house and it was not illegal. We paid $500 a month to this “investment company” while we continued to apply for loan mods with other firms.

Meanwhile, I became a father again, extended my career as a photographer and my business was solid.

On December 23, 2015, I got a call from our “investment bank” that Wells Fargo was going to auction off our house and that the only way to stop it was for me to file a personal bankruptcy, even though I had received no notification about it whatsoever from Wells Fargo!

So tragically, at age 65, with the perfect credit, and with less than 30 min notice, on Dec 23, 2015 I had to file bankruptcy.

Wells Fargo had no intention of working with me to save my house from the start.

Within 24 hrs, all of my credit, including on line payment on credit cards, car lease, etc, shut down. I could no longer pay or access my accounts, and all I had worked for my entire life was in shambles. (Later, the bankruptcy was dismissed, of course. Since I didn’t need to file a BK. And the attorney was so sloppy, he didn’t tell us what documents to submit)

Merry Christmas and Happy New year.

I then hired yet another law firm, J.T. Legal in Glendale . They filed a “Lis Pendens” to prevent an eviction and tried to prove the illegality of the sale. I thought Wells Fargo had already sold the house but there seemed to be no record of it.

At the end of J.T.Legal’s service, Sep. 2016, Wells offered this “settlement” (Helms – Release Agreement ) which offers NO guarantees. It offered an “opportunity to fill out paperwork to POSSIBLY be eligible for a loan modification,” and it also included a sign off of all my present and future rights. I refused to sign because I had seen these attempts to “silence the consumers contracts” from Wells before.

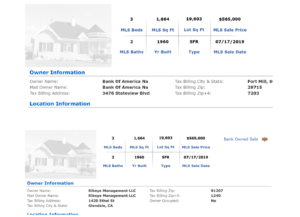

At this point, the house was supposedly “sold” to bank of America, the investor, so it would be foolish of me to think Wells Fargo could revive our loan anyway.

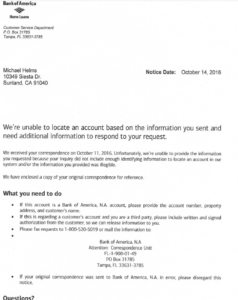

In September 2017, I sent Qualified Written Requests to Wells Fargo, Bank of America, and First American Title Insurance, asking for all paperwork regarding my house. I wanted to know who REALLY owned it. Wells Fargo said they couldn’t give us any info on the house because it was in litigation. (not true – as a “servicer of the loan, they are required by law to provide us with a point of contact).

Bank of America responded by saying they had no information about our house. Bof A 10_14_16 unable. Unable to locate “loan” – while I was specifically asking for the docs to prove their ownership.

First American replied that they were just the trustee and had no involvement in it.

Here’s the Wells reply. There were NO documents attached to this letter. WellsReplyOct132016

In Nov 2017, 11 months after the “alleged” sale day, Wells Fargo recorded a sale in the LA County record. By law, banks are required to record sales within 3 months.

Deceptively, Wells Fargo had been making “offers of settlement” when the house “had been sold.” If they offer a possibility of loan modification, as part of settlement, they must get the title company involved for insurance purpose which means a preliminary title report was required. The preliminary title report would have required the investigation into the final Notice of Trustee’s sale set for December 23, 2015. JT Legal should have been given the preliminary title report from Wells Fargo on my behalf. This means Wells deceived JT Legal and me.

In 2017, Michael Zeff, Bank of America’s eviction attorney sent me several eviction notices. One on President’s Day, one on Easter Week, and one on Fourth of July week. Zeff does this with eviction notices because the homeowners or renters, have only 5 days to file their responses and holiday weekends reduce the ability and opportunity to respond. It’s not an illegal practice but it’s inhuman, immoral, and unconscionable to use holidays as a shield against viable responses to eviction.

In May 2017, I found out I had two life threatening heart conditions. Mitral valve prolapse AND Atrial Fibrillation.

At the Unlawful Detainer (Eviction) case hearing with Michael Zeff in July 2017, I was lied to in court by an attorney, who was representing Zeff, who said I had to sign over my house or be evicted in 5 days. SHE told me, if I signed the house over, I would have 30 days to move out. How could I move out of my home of 18 years within 5 days? I had a 4 year old child and my business studio was attached to the house in back? I felt forced to sign it – while she was saying that I was making the right decision.

It was not true.

Michael Zeff, Bank of America’s attorney also jumped jurisdiction and took our case to the Pasadena court instead of Stanley Mosk or Burbank. He was getting “better” results for his firm in Pasadena Court. Also, he never replied to our response on the unlawful retainer case and he just filed the eviction notice. We will go after this illegality as well.

I moved the case to the Federal Court- 9th circuit. Wells Fargo attorneys continued to use fraudulent documents as evidence of sales. At the first hearing in July, 2017, when the Judge Consuelo Marshall asked Andrew Minegar of Severson and Werson, if the title was perfected, he answered: Yes, your honor. I wanted to scream “LIAR!” – but that’s not how the court system works. I need to prove that he lied by filing more papers. Fortunately, his statement is in the court transcripts.

Andrew Minegar was replaced by another attorney the following week.

On October 17th, 2017, I was told by my cardiologist I needed to have open heart surgery immediately because I was at a very high risk of heart attack or stroke.

On October 18, 2017, in the early morning hours, we were awakened by the LA county Sheriff banging on our door telling us to get out of our home. The Sheriff let me make 3 trips to my car, loading what I could, then refused to let me go back in for more of our belongings. He stood in front of the door to my home with his hand on his gun and his deputy behind him with his hand on his gun, and told me to get out. (names of the sheriff – and pictures here)

My girlfriend said, “We’ll figure something out later. I need you to take care of your health right now.”

We spent the next two nights in a tent in our friends back yard, and then luckily found an Air BnB condo for 5 months , costing us $3400 a month.

With other homeowners and real estate agents, I went over the paperwork again to document how we were misled and how Wells Fargo violated the legal system. We even found fraud by Wells Fargo on the city foreclosure registry. A group of homeowners, who have investigated several attorneys in the Southern California area, are filing a case with the State Bar. Bank attorneys are part of this foreclosure mill process that enables predatory lenders to continue.

Wells Fargo continues to contaminate the real estate market and county records with fraudulent documents – and continues their deceptive practices to take homes away from citizens.

Kamala Harris’ Homeowners Bill Of Rights cannot be legally binding when no judge is willing to enforce it. City Councils, County supervisors, and State Senators will be needed to push to make this bill enforceable.

We have an active case in Federal Court – but most of our case was dismissed because California is a non-judiciary state and securitization of the loan and its title mean nothing to the judges at this moment, in spite of the illegality of it.

So, my fight continues….

Dec. 2018. We just received a letter from IRS. It looks like Wells Fargo just filed another fraudulent document – More #evidence… more on “UPDATE” page)

===

August 15, 2018 – ABOUT THE PETITION

We are still happy and grateful for our friends, but I miss the Siesta house where neighbors, families, friends and artists gathered. Every morning, I miss feeding birds while sipping coffee. We did shows, film shoots, and goofy parties in that house. It was the “go to house” for “orphan artists of LA” since 1999, til we were evicted by an LA county Sheriff by order of Bank of America on Oct 18, 2017, while I was building a Halloween costume for my son.

For over a year, there was NO movement on the house because of the litigation. The house was just sitting there, falling into disrepair..

In May 2019, through the attorney Raagini Shah of Reed/Smith, representing Wells Fargo, we thought Wells Fargo FINALLY was willing to sell us the house. Raagini emailed me Wells is willing to sell the house for $620k or more.

Huh?

Note: $415k was what I owed on mortgage at 5.75%.

There are also surplus funds of $150k – the money Wells made when they “sold” the house to Bank of America (for the 2nd time). This is money in excess of my mortgage amount and should be returned to me.

It was end of May 2019 when the attorney Raagini Shah of Reed/Smith, representing Wells Fargo, quoted us that price – so we started to working on getting a home loan.

On June 7th – Wells Fargo listed the house for sale. (attach the REO listing here.) For $575k. $45k lower than they offered me.

The listing Agent was Mike Anderson of Brokers in Trust. Kaz contacted him – and a week later, a man called Hosep Stepanian called me back. He told Kaz the house is sale for CASH only, No inspection, No Title insurance.

Kaz called a highly respected mortgage broker Jason, a CalHFA rep – who is extremely knowledgeable and executes each mortgage with precision and very much “by the book” . He said “No title insurance – No loan.” Kaz got referred to a “hard cash guy” – and he even said “No one would give you a loan without title insurance – unless you get some indemnity.”

I was devastated. We shared our journey with friends via weekly emails and when a close friend of mine, the godfather of my son, read this, he called Hosep, willing to lend us the cash to get the house for us.

Hosep told him the house was “already in escrow”. That was fishy …who would say “no” to cash? And every smart agent would take his info as back up.

About the same time, Raagini Shah of Reed/Smith, representing Wells Fargo, sent a letter saying,”DO NOT contact Wells Fargo or its agents”. (Letter)

Things were getting fishier.

On Fri. July 12 – I was on location shooting when a neighbor called to say “Someone is in your house”. Kaz went there within 5 min – and met the guy who bought the house…with cash…and with title insurance, he claimed.

Kaz asked,” How did you get title insurance with the so many frauds on the title?” He said,”I guess we did all the work for you.” He agreed to give her the AS IS cash price.

Emails, Texts , and calls from media – NOTHING for two weeks.

She was convinced there were some closed door dealings among those Wells Fargo reps and investor/real estate agents involved and that were blocking us from buying the house so she continued to check property records three times a day. My son’s godfather said “It’s called Conspiracy”. Sure enough it is actually a legal term. (https://definitions.uslegal.com/c/conspiracy)

We reminded ourselves – there are LAWS out there supposedly to protect us. LA County opened an investigation for us, Fair Housing (both HUD and CA) have been helpful filing the complaints, CA Department of Real Estate (DRE) has very strict codes of conduct, as well as the IRS. The IRS is aware that house flippers do many transactions in cash. It is NOT illegal to do cash transaction, but it is illegal to NOT report it.

There are laws – and it is up to us to bring these atrocities to the attention of those who enforce those laws. If you are robbed but don’t report a robbery, that robbery is non existent in the eyes of the law.

On July 14, – Bank of America sold the house to Bank of America again (yes – they sold it to themselves), conducted by the servicer Wells Fargo – and a few days later, on August 2nd Kaz found a transaction to Ribeye Management was recorded as on the same day … July 17.

Who the hell is Ribeye? I googled https://opencorporates.com/companies/us_ca/201135510006 and found the phone number they listed on another page was (818) 244-7444 – disconnected.

I decided to send a copy of the Request of Fraudulent real estate transaction – that the County accepted – to the Address and officer of Ribeye Management Adle Suarez.

While looking for the real estate records, Kaz found the loan provider CALCAP Lending, LLC in Pasadena, and emailed them. Nope, they cannot give us the info on Ribeye Management.

The company address they filed with the state was 1030 Foothill Blvd., La Canada 91011. Kaz did reverse search and found it was the office of Dilbeck – La Cresenta. So Kaz went by name by name of their real estate agents, and found Ralph Suarez, the same last name. Adle could be his relative! Kaz sent him a email right away.

On Monday, he finally emailed back “call me”

They had a nice conversation, and Kaz was led to believe he would give her a price on the house to purchase “as is”.

Next thing we know – he sent her this threatening text message.

(Text pic here)

And somehow he was bothered by the banner we put up with consent from the neighbor to warn the people who are considering buying the house BEFORE he purchased the house.

His lawyer requested we take down the banner and our website – (Cease and Desist Letter Suarez Letter 8-9-2019.

Kaz said: Do you think he read about our struggle and he still wants to take the house away from us? And he is not informing the potential buyer about the pending litigation? I need to find out if it’s ethical for real estate or investors to do that.

Mean while, Bank of America replied to our QWR, that was sent to the address Wells Fargo provided AND the address BofA provided – about the ownership of the house. They STILL cannot find the address on their records.

In California – the wave of buying foreclosures with made up ownerships and fake paperwork is finally coming to the attention of our legislators as a significant contributor to homelessness. And “flippers” or “gentrifiers” are being considered as a part of the problem due to the non judiciary foreclosure process and homelessness issues.

https://livinglies.me/wp-content/uploads/2019/07/2019.07.15-Minute-order-for-MSJ-1.pdf

&

https://www.sacbee.com/news/politics-government/capitol-alert/article233626287.html

If our federal case is dismissed, we will file another one, based on ANOTHER fraud we found. I know we didn’t do ANYTHING wrong – and we were victims of fraud by Wells Fargo. We have evidence and will continue to fight.

We both know “it’s just a house” but at the same time, it was our HOME. It is where we created so many memories – and we were conned by Wells Fargo’s systematic fraud, punished for a crime Wells Fargo committed. They devastated our finances, health, and business.

If we lose the house we will lose everything we built in Los Angeles.

6 Million houses were foreclosed since the recession and many people walked away. Maybe I should have – but I couldn’t. I couldn’t let the fraud or big money people win and destroy what we all worked so hard for.

I just didn’t imagine ONE BIG Wells Fargo LIE could take everything.